|

Have You Thought About Leaving Puffy Paws In Your Will ?

Donate

Any Amount You Would Like By Clicking On The Gold

Click Here To View Our IRS Determination Letter For Our Non Profit Status

Click Here To View Our Non Profit Papers With The Florida Department of State - Division of Corporations.

Click Here To View IRS Form 990 For 2014

Click Here To View IRS Form 990 For 2015

Click Here To View IRS Form 990 For 2016

| Sign Up For Our Updates & SOS's

|

|

|

Planned Giving Is

Investing in the Future

of Puffy Paws Kitty Haven Which

Assures the Security and Survival of All The Special Need & Unwanted

Kitties That Are Living Out Their Life's At Puffy

Paws Kitty Haven

A planned gift

is one which you make during your lifetime but which is not received by Puffy Paws Kitty Haven until a future date. It could

offer financial benefits to you, the investor, now while you are living.

Did you know there are planned gifts

that you can make and enjoy certain IRS tax benefits Now while having the joy of knowing you are undergirding the future of

these precious special needs kitties.

Please contact

your Law Firm for further guidance or please contact ours: Dawn Marie Bates-Buchanan, Esq. 941-749-3015.

Puffy Paws Kitty

Haven's contact number 941-623 -8904.

Considerations for Planned Giving - A Will

Surveys show that only 4 out of 10 Americans across all age groups have current wills, concluding that this is a subject

most people avoid. If a will is one of the most important documents you can own, why do so many people live without them?

Perhaps they think that by postponing death planning, they can postpone the inevitable? Or maybe they simply don't

want to take the time or money (a relatively small amount) required to create an up-to-date will.

We suggest that

it is time to think differently about a will. Think of planning a will as planning to improve and stabilize the financial

security of yourself and your family. By thinking in this way, you will be putting present goals first. You may have heard

that if you die without a will, the state will take all of your property.

While this is not usually true, it is

fact that the state in which you live at the time of death is going to step in and determine exactly how your property is

distributed—unless you have prepared a will.

Without a will, your wishes and good intentions are meaningless.

Your estate will be divided using a predetermined formula that won’t take into account special needs or circumstances.

In most states, your assets will go to immediate family—a portion to a surviving spouse and a portion to any

children you may have. If you have no immediate family, they will be divided among other relatives. State laws do not provide

for close friends, employees or other loved ones, such as your spouse’s family members.

Neither the old friend

that you wanted to remember with a treasured heirloom or the next-door neighbor who was always there to help will receive

as much as a dime if you don’t have a will.

The same holds true for charitable organizations that you may

have wanted to support generously after your death. If there is no will, there is no support.

A will allows you

to remember the people you care about and the kitties at Puffy Paws Kitty Haven.

Bequests

If you plan

to make a charitable gift by will, please think it through carefully. Then, meet with your attorney to discuss and update

your will. Tell him or her exactly what you want to do.

Such As:

A General Legacy Statement:

I __________ devise and bequeath to Puffy Paws Kitty Haven, Inc., a non-profit agency registered in the State of Florida,

the sum of $_____ (or otherwise describe the gift; often a percentage of the estate is designated) to be used in the furtherance

of its mission and general purposes.

Be as clear as possible in describing what you want given to whom.

Here are eight generally accepted ways to make a bequest. You might discuss

them with your attorney as you prepare to update your will.

The following items

can apply in the case of bequests to individual heirs or bequests to charitable organizations.

Specific bequest. This is a gift of a specific item to a specific

beneficiary.

General bequest. This is usually a gift of a stated sum of money. If there

is not enough cash in the estate for the specific sum, other assets must be sold to meet the

bequest.

Contingent bequest. This is a bequest made on condition

that a certain event must occur before distribution to the beneficiary. A contingent

bequest is specific in nature and fails if the condition is not met. (A contingent bequest is also appropriate

if you want to name a secondary beneficiary, in case the primary beneficiary doesn't survive you.)

Residuary bequest. This is a gift of all the "rest, residue

and remainder" of your estate after all other bequests, debts and taxes have been

paid spouse.

The following items are special considerations when you plan a charitable bequest

to help support the mission of Puffy Paws Kitty Haven.

Unrestricted bequest. This

is a gift for our general purposes, to be used at the discretion of our founder/director

and Board of Directors. A gift like this–without conditions attached–is frequently

the most useful, as it allows us to determine the wisest and most pressing need for

the funds at the time of receipt.

Restricted bequest. This type of gift allows you to specify

how the funds are to be used. Perhaps you have a special purpose or project in mind.

If so, it's best to consult us when you make your will to be certain your intent can

be carried out.

Honorary or memorial bequest. This is a gift

given "in honor of" or "in memory of" someone. We are pleased to honor your request and have

many ways to grant appropriate recognition.

Endowed bequest. This

bequest allows you to restrict the principal of your gift, requiring us to hold the

funds permanently and use only the investment income they generate. Creating an endowment

in this manner means that your gift can continue giving indefinitely.

Methods

of Giving

Charitable Gift Annuity

The concept

of the charitable gift annuity in America dates back to the 1870s, when a parishioner first donated

a valuable asset to the church in exchange for a flow of income. Today, the concept includes

valuable tax benefits for donors.

Charitable Remainder Trust

What are your plans for the future?

While there is no single way to achieve all of your personal and financial goals, there is one

strategy that can meet many of your needs. It's called a charitable remainder trust. In the right

circumstances, this plan can increase your income, reduce your taxes, unlock appreciated investments,

rid you of investment worries and ultimately provide very important support.

Charitable

Lead Trust

If your goal is to provide an inheritance for your children, but you would also

like to make a significant charitable gift through your estate, find out how a charitable lead

trust can help you satisfy both objectives. It's a charitable lead trust that can provide a significant

charitable gift through your estate and provide an inheritance to your children.

Wealth

Replacement Trust

Perhaps you would like to make a sizable contribution to

Puffy Paws Kitty Haven now to help meet our current needs, but you don't want to reduce the estate you will

pass to your family. The solution? Purchase life insurance.

Retained Life Estate

One of your valued possessions, your home, can become a valued gift to us even while you

are still living in it, and even if you want your spouse or other survivor to live there for

life. This arrangement is called a retained life estate.

Bequests

Leave your legacy

by making a gift in your will to friends, family and charitable organizations. A bequest is one

of the simplest ways to remember those you care about most.

Assets to Give

Gifts of Securities

The best stocks to donate are those

that have increased greatly in value, particularly those producing a low yield. Even if it is

stock you wish to keep in your portfolio, by giving us the stock and using cash to buy the same

stock through your broker, you will have received the same income tax deduction but will have a

new, higher basis in the stock

Gifts of Real Estate

If you own property that is

fully paid off and has appreciated in value, an outright gift may be the simplest solution. You

can deduct the fair market value of your gift, avoid all capital gains taxes and remove that

asset from your taxable estate. You can transfer the deed of your home or farm to us now and keep

the right to use the property for your lifetime and that of your spouse.

Gifts

of Retirement Plan Assets

Did you know that nearly half your retirement plan assets can be eaten

away by taxes at your death? Learn how to preserve more of your estate for the people and organizations

that matter most in your life.

Gifts of Cash

The simplest

way to give. However, you can deduct a cash gift for income tax purposes only in the year in which

you contribute it. Your cash gifts are deductible up to 50 percent of your adjusted gross income

for the taxable year, but any excess is deductible over the next five years.

Gifts of Life

Insurance

You can donate a life insurance policy to us or simply name us as the beneficiary.

For the gift of a paid-up policy, you will receive an income tax deduction equal to the lesser

of the cash value of the policy or the total premiums paid. To qualify for the federal charitable

contribution deduction on a gift of an existing policy, you must name us as owner and beneficiary

Gifts of Securities: Closely Held Stock

Closely held stock,

that which is not publicly traded, can also be used as a charitable gift even if you want to maintain a control position

in the stock.

Which

Gift Matches Your Goals?

Whether you want to eliminate taxes or benefit

from an increased income stream, there is a gift to fit every objective. And no matter how or

what you give, rest assured that you will be helping out animals that have been abused homeless and stray.

Your

gift will help those in need now and those yet to be born.

Please contact your Law Firm for further guidance or please conatct

ours: Dawn Marie Bates-Buchanan, Esq. 941-749-3015.

Puffy

Paws Kitty Haven's contact number 941-623 -8904.

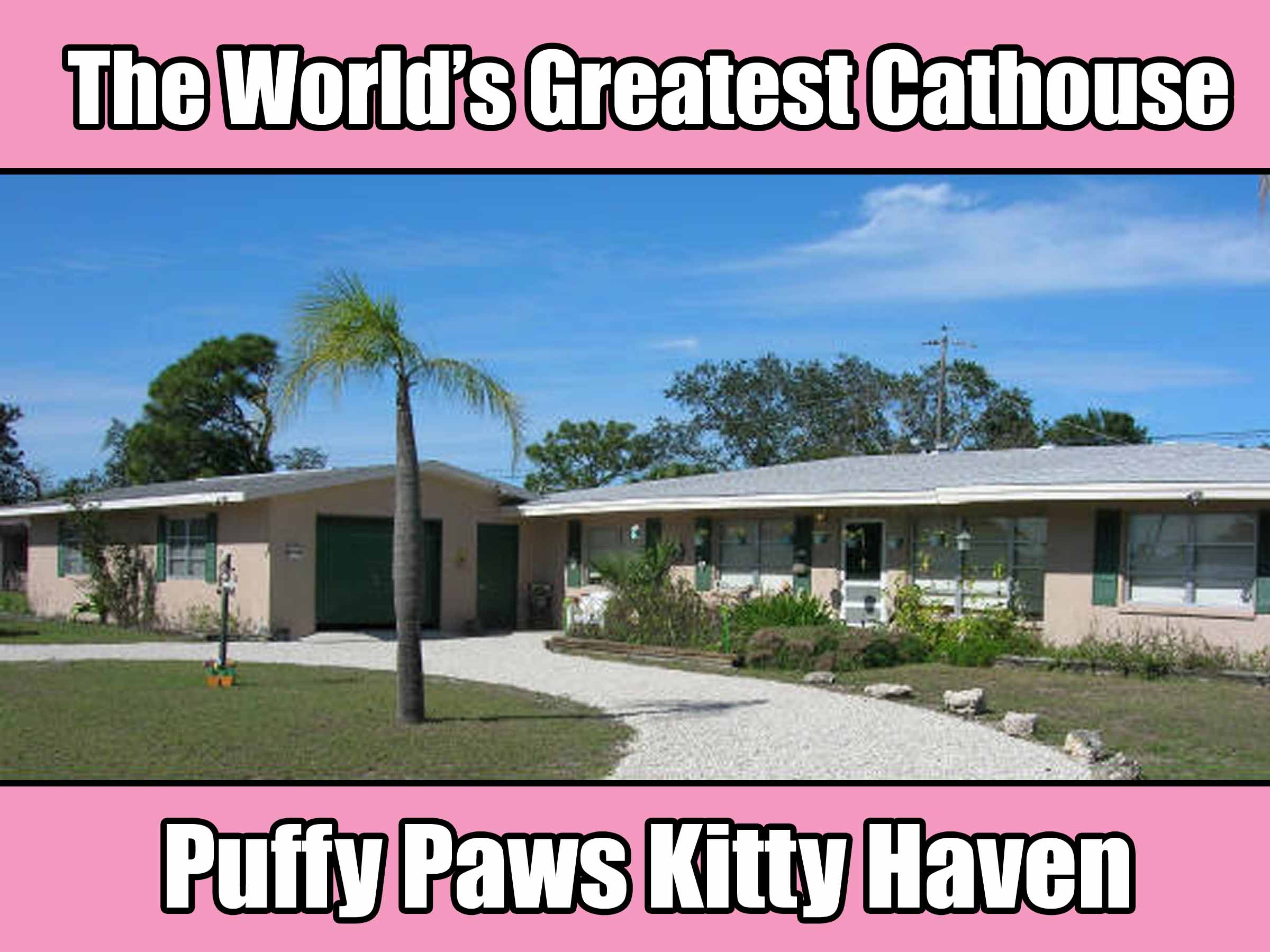

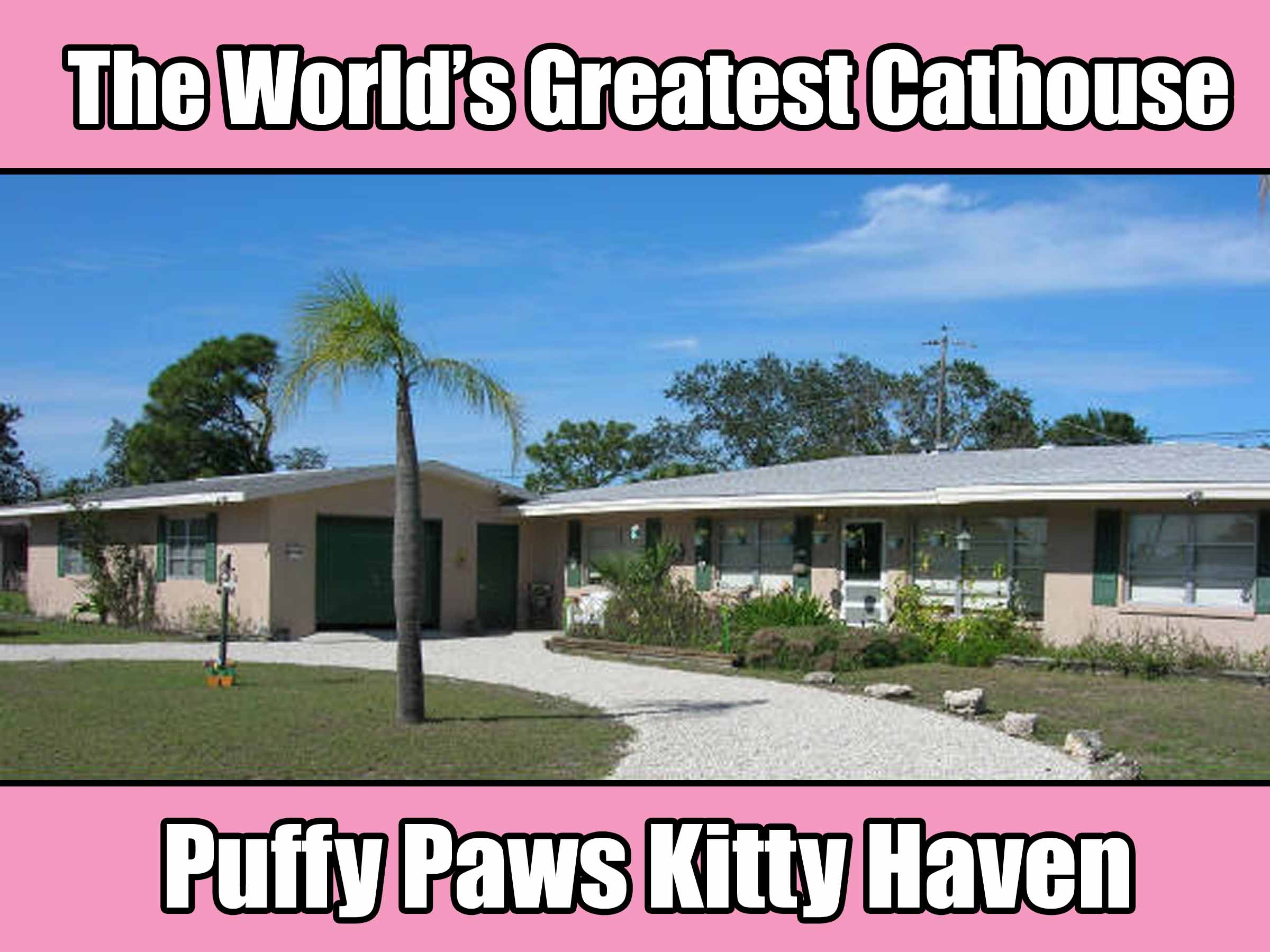

Those touched by the Mission of Puffy Paws Kitty Haven share a common legacy.

With that legacy comes the opportunity, and the responsibility, to play a fundamental

role in continuing Puffy Paws Kitty Haven - “Hallmark of Making A Difference.”

We believe that all gifts are important. Puffy Paws Kitty Haven could not operate without

caring people who share our Vision and Mission. We also know that it is the consistent annual giving of all those who

treasure the Mission that remains paramount to our existence and will continue to provide the

foundation of all giving.

As you review our giving opportunities, be reminded of the

privilege and responsibility we have to be good stewards. When you support Puffy Paws Kitty Haven,

you demonstrate your commitment to a No Kill way of life

EVERY KITTY DESERVES TO LIVE

NO GIFT IS

TOO SMALL TO MAKE A DIFFERENCE

MAD KITTY LOVE TO YOU

Thank

You

Rick & Chrissy Kingston & Da Kitties

Founders

Puffy Paws Kitty Haven

|